In today’s financial climate, many are turning to low-risk bonds to bolster their investment portfolios. Among these, the Singapore Savings Bonds (SSBs) stand out as a reliable choice with steady interest rates and no risk of capital loss.

What Are Singapore Savings Bonds (SSBs)?

Singapore Savings Bonds (SSBs) are investment instruments fully backed by the Singapore Government, making them one of the safest options available. With no risk of capital loss, investors are guaranteed to get their investment amounts back anytime.

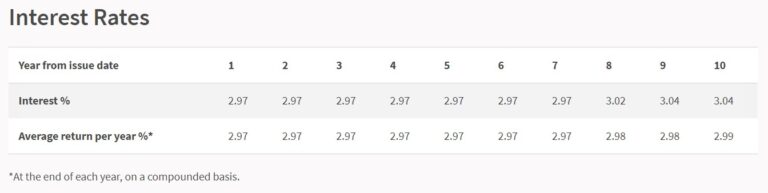

SSBs also feature step-up interest rates, meaning the longer you hold them, the higher the interest income you’ll earn. Additionally, investors enjoy the flexibility to redeem their SSBs anytime without penalties.

Key features of SSBs include:

- Step-up Interest: Annual returns increase progressively with the duration of your investment.

- No Capital Loss: Your investment is principal-protected, even if you redeem it early.

- Tax-Free Returns: Interest earned from SSBs is exempt from tax.

Current Interest Rates and Updates

Current Interest Rates and Updates

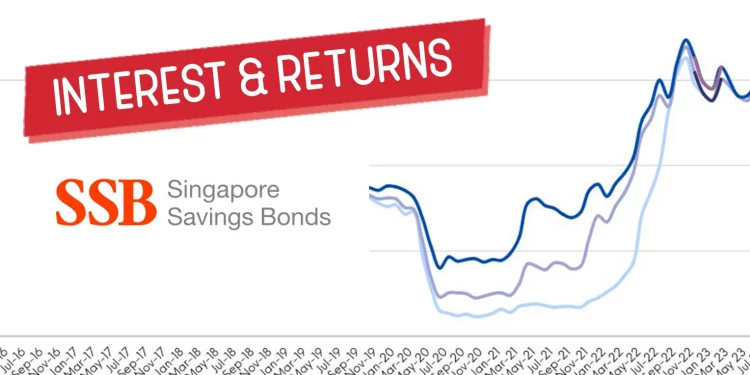

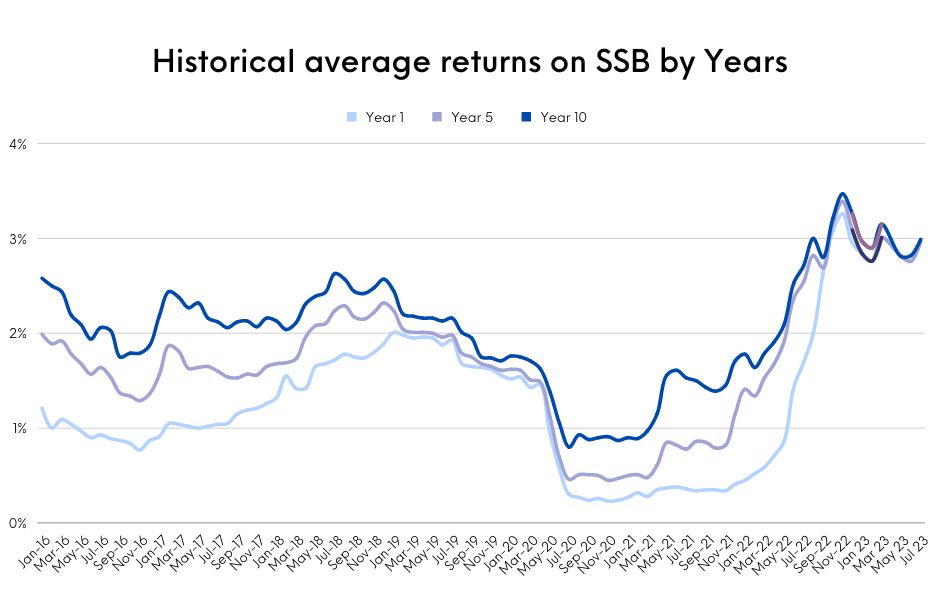

Singapore Savings Bonds were introduced in 2015. The interest rate was around 3-4% back then but dropped to below 1.5% in 2020. Today, interest rates are rising, and SSBs are gaining recognition.

Why Invest in SSBs?

- Minimal Risk:

Rated AAA by leading credit rating agencies like Moody’s and S&P, SSBs carry negligible default risk, making them suitable for conservative investors. - Flexibility and Liquidity:

Unlike fixed deposits, SSBs allow early withdrawal without penalties, offering liquidity when needed. - Accessibility:

Investing in SSBs is simple. You only need:- A local bank account (DBS/POSB, OCBC, UOB).

- A Central Depository (CDP) account linked to your bank account.

- Low Entry Cost:

The minimum investment amount is S$500, making it affordable for beginners. - Non-Transferable:

SSBs cannot be traded or used as collateral, ensuring a stable investment option.

How Much Can You Earn?

SSBs offer competitive returns compared to traditional savings accounts or fixed deposits. Here’s an example:

- For an investment of S$10,000, the average annual return could be approximately 3.22%, translating to about S$322 annually.

- Interest payments are made semi-annually and credited directly to your bank account.

For conservative investors, the SSB’s interest rates aren’t bad.

While they weren’t as high as long-term CPF funds, they were at least higher than short-term fixed deposits and savings accounts.

How to Apply for SSBs

Follow these steps to start investing:

Before Applying

- Ensure you have a CDP account with Direct Crediting Service (DCS) activated.

- Have a bank account with DBS/POSB, OCBC, or UOB.

Application Process

- Through Cash:

- Use your bank’s ATM or online banking platform.

- Invest in multiples of S$500, with a S$2 transaction fee per application.

- Through SRS Funds:

- Apply via your SRS operator’s online banking portal.

Allotment Results

- MAS announces allotment results on the third-last business day of the month.

- If oversubscribed, you may receive a partial allotment, with refunds processed promptly.

Is SSB Right for You?

SSBs are ideal for those seeking:

- Stable, low-risk investments.

- Flexibility without lock-in restrictions.

- Tax-free returns.

While they may not offer the highest returns, SSBs are a great way to diversify your portfolio and lock in guaranteed long-term income.

Stay Updated

For the latest interest rates and application deadlines, visit the MAS website. Don’t miss the chance to secure your financial future with one of Singapore’s safest investment options!

(Credits: Drwealth, MAS)

Since you’re here, why not read: