We look forward to 2023 with excitement, but one thing that we probably won’t be very excited about is the increase in the Goods and Services Tax (GST) to 8%.

As you probably already know, this GST increase was originally scheduled for 2021. Due to the pandemic at the time, this was deferred until 2023. By 2024, expect a further 1% increase, bringing the total to 9%.

Because the last GST increase was in 2007, most of us might not be fully aware of how it will affect us. The following are some things you need to know about the upcoming increase, along with some scenarios that might affect you.

By now, it should be clear that things will cost more with a 1% increase in GST. Shops, restaurants, and service providers will factor this increase in come 1st Jan 2023, so don’t be too surprised if your $10.90 plate of food now costs 10 cents more.

GST will also be applied to low-value goods imported via air or post – such as those you buy online – that are imported from overseas. GST is currently exempt from these “low value” goods, defined as items valued below $400, but in 2023 that will change.

Items you order from overseas with a value less than $400 will be subject to 8% GST.

According to the Government, the reason for this implementation is so that it will “help to level the playing field for local businesses to compete effectively”, else they’d lose out to overseas retailers and vendors.

The article doesn’t end there. In addition, GST will now apply to all non-digital services, including those from overseas. Online counseling, telemedicine, and distance learning classes are some examples here.

Other scenarios you might face with purchases and how the increase will affect them are as follows:

Bringing items back to Singapore after buying them overseas

This year-end as many of us head off for exciting holidays, remember that GST doesn’t just apply to items bought in Singapore, but also to items bought abroad and brought back to Singapore.

As a general rule, if your trip is longer than 48 hours, you will get GST relief up to $500, then be taxed on the amount above that threshold. As an example, if you buy a laptop for $1,400, you’ll get GST relief for the first $500, and taxed the remaining $900 at the prevailing rate. A $100 relief is available if your trip is less than 48 hours long.

As far as this scenario is concerned, it’s pretty straightforward. Before 1 Jan 2023, the item you purchased while on vacation will be subject to 7% GST. Thereafter, it will be subject to 8% GST. The 7% tax will apply if you purchase the item before 1 Jan 2023 and only arrive in Singapore afterward.

Payments were made in 2022, but items will not arrive until 2023

Pre-ordering an item in 2022 may result in receiving it in 2023, although you paid for it in 2022.

Are you pre-ordering furniture? The GST increase won’t affect you.

GST is first calculated based on the item’s value. As of right now, goods under $400 are exempt from GST, while goods above $400 are already taxed at 7%. Therefore, it doesn’t matter when you receive the latter.

The GST will remain at 7% if you’ve paid in full for the goods before 2023 but won’t receive them until after.

The deposit was paid in 2022, but the remainder was paid in 2023

For large-ticket items such as wedding packages and furniture, some of us may have put down a deposit in 2022, before paying the remainder after the 1st of January in 2023.

GST can be calculated quite easily in this situation. As far as your deposit paid in 2022 is concerned, you will only need to pay the current 7%, plus any other payments you plan to make to chip away at the remaining amount. GST rates will increase to 8% after 1st Jan 2023. Therefore, it’s best to read the fine print on any terms and conditions before making a purchase.

As a means of attracting customers, some retailers might offer to “lock” you into the 7% for the duration of your purchase. They’re basically helping absorb that 1% increase because they’ll still have to pay 8% to the government, while you’ll only have to pay 7%.

Amounts paid in installments through 2023

Installment plans are another common scenario. As buy-now-pay-later platforms become more popular, consumers can divide payments between tranches to ease their wallets.

Before the 1st of January 2023, all installment payments will be taxed at 7%, and after that date, they will be taxed at 8%. In this case, we assume you made the purchase in 2022 with the expectation that your item would not be delivered until 2023.

All subsequent installments, even if you’re paying for them in 2023, will be pegged at 7% if you receive your item before 1st Jan 2023.

Payment and goods received in 2023, but invoiced in 2022

As an example, if you signed an invoice for a renovation, the work won’t begin until 2023.

You may receive the vendor’s first invoice in 2022, but you won’t receive the goods until 2023 for one reason or another.

It is right for the initial invoice to reflect 7% GST in this case. In contrast, if you only make full payment and receive your items in 2023, you will be liable to pay 8% GST. In the case of a GST of 8%, the vendor will have to cancel the original tax invoice and issue a new one.

Singapore’s upcoming GST changes

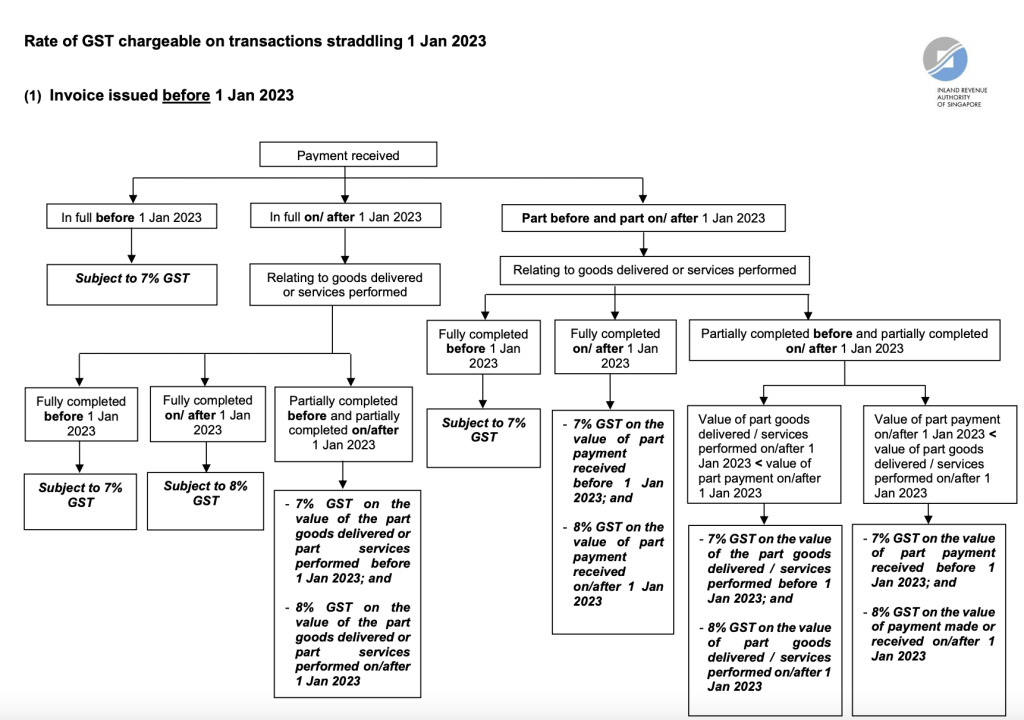

IRAS has very kindly provided a flowchart to help consumers understand how the GST increase might affect them:

GST increases: how to navigate them

We are less than a month away from the GST increase and the new rules taking effect, so you may be wondering how to “save” money.

In order to reduce the amount subject to 8%, you can pay off all of your expected or existing purchases in 2022, so that you’ll pay the existing rate of 7% for as much as possible.

Although a 1% increase may not seem like much, it wouldn’t harm us to save wherever we can. If you can afford it, pay off your purchases as much as possible before 1st Jan 2023.