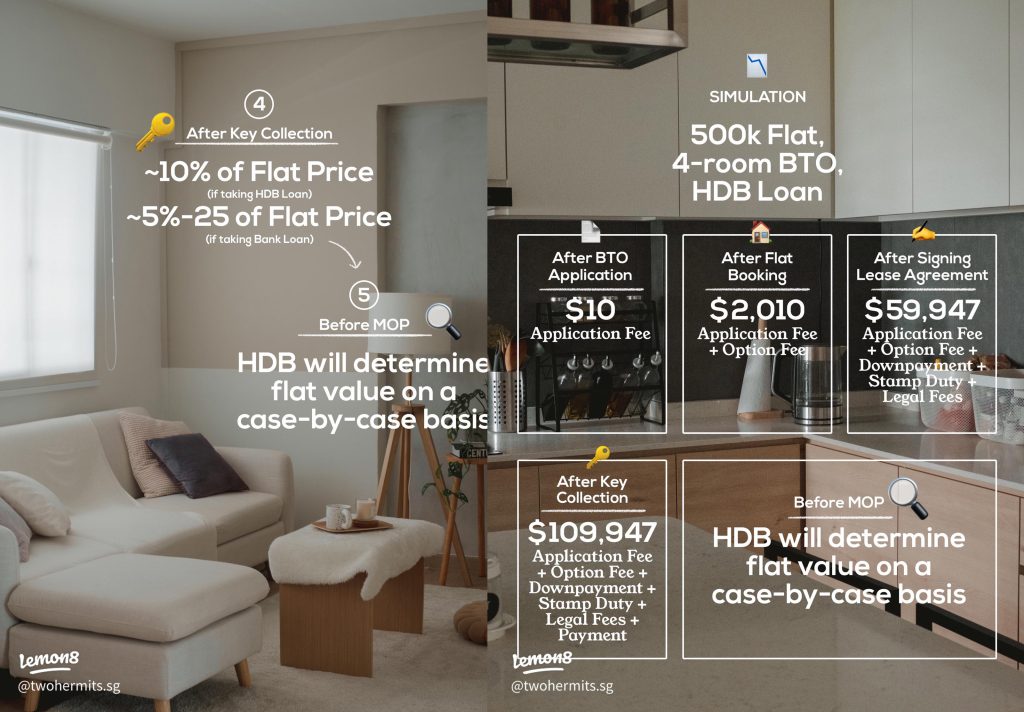

Breakups during BTO applications bring uncertainty and financial concerns. Here’s a summary of potential costs when canceling HDB BTO, as revealed by Netizen Two Hermits.

In Singapore, a proposal is often made by asking, ‘Want to BTO?’. Many BTO projects are facing delays and rental prices are skyrocketing, so it’s no wonder young couples are rushing to find a flat as soon as possible. But did you know that in 2020 alone, around 1,700 BTO applications were canceled? Your relationships might have changed during the long waiting time for a BTO, or you might need to cancel your BTO flat for various reasons. What is, then, the true cost of heartbreak in Singapore (BTO edition)?

Here’s what you need to pay for each stage of a BTO application :

1. After BTO Application

Application fee: $10

If you receive a queue number for flat selection and don’t choose a flat, you will lose first-timer priority for future BTO applications for 1 year.

2. After Flat Booking

Option fee: $500 (2-room Flexi), $1,000 (3-room), $2000 (4-room or larger)

(psst.. the option fee counts towards the downpayment of your BTO flat)

You can’t apply for BTO, resale (with housing grants), DBSS, or EC flats for a period of 1 year from the flat cancellation date. You will also lose your first-timer priority for future BTO applications for 1 year.

3. After Signing the Lease Agreement

Downpayment: 10% of the flat price (if taking an HDB loan), ~20% of the flat price (if taking a bank loan)

Stamp duty: Stamp duty is based on the price of the flat (1% for the first $180k, 2% for the next $180k, 3% for the next $640k, and 4% for the remaining amount). Check out the Stamp Duty Calculator for a more accurate calculation.

Legal fee: Legal fee is based on the price of the flat ($0.90 per $1,000

for the first $30k, $0.72 per $1,000 for the next $30k, and $0.60 per $1,000 for the remaining amount, plus 8% GST)

You can’t apply for BTO, resale (with housing grants), DBSS, EC flats for a period of 1 year from the flat cancellation date. You will also lose your first-timer priority for future BTO applications for 1 year.

4. After Key Collection

Payment: 10% of the flat price (if taking an HDB loan), ~5-25% of the flat price (if taking bank loan)

5. Before MOP (5 years for normal BTO and 10 years for PLH flats)

The MOP must be fulfilled before the BTO flat can be sold on the open market. Otherwise, HDB will repossess it and determine a suitable compensation. HDB may approve the sale of BTO flats in the open market before the MOP is fulfilled for reasons such as financial hardship, divorce, or death. Aside from this, you will also lose any renovation and furnishing costs.

The following is a simulation of the amount of money you would lose if you were to cancel your BTO application at various stages:

1. After BTO Application:

-$10 Application Fee

-Loses first-timer priority for 1 year

Total: – $10

2. After Flat Booking:

-$10 Application Fee

-$2,000 Option Fee

-Loses first-timer priority for 1 year

-You can’t apply for BTO, resale (with housing grants), DBSS, or EC flats for a period of 1 year from the flat cancellation date.

Total: – $2,010

3. After Signing the Lease Agreement

-$10 Application Fee

-$2,000 Option Fee

-$48,000 Downpayment (~ 10% of flat price minus $2,000 Option Fee)

-$9,600 Stamp Duty (1% for first $180k, 2% for next $180k, 3% for next $640k, 4% for remaining amount)

-$337 Legal Fees ($0.90 per $1,000 for first $30k, $0.72 per $1,000 for next $30k, $0.60 per $1,000 for the remaining amount, plus 8% GST)

-Loses first-timer priority for 1 year

-You can’t apply for BTO, resale (with housing grants), DBSS, or EC flats for a period of 1 year from the flat cancellation date

Total: – $59,947

4. After Key Collection :

-$10 Application Fee

-$2.000 Option Fee

-$48.000 Downpayment (~ 10% of flat price minus $2,000 Option Fee)

-$9,600 Stamp Duty (1% for first $180k, 2% for next $180k, 3% for next $640k, 4% for remaining amount)

-$337 Legal Fees ($0.90 per $1,000 for first $30k, $0.72 per $1,000 for next $30k, $0.60 per $1,000 for the remaining amount, plus 8% GST)

-$50,000 Payment (~ 10% of the flat price)

-Loses first-timer priority for 1 year

-You can’t apply for BTO, resale (with housing grants), DBSS, or EC flats for a period of 1 year from the flat cancellation date.

Total: -$109,947

5. Before MOP

-??? (flat sale price will be determined by HDB on a case-by-case basis)

-Renovation & furnishing costs

Applying for a Built-to-Order (BTO) flat is a significant decision that involves financial obligations. Prior to submitting your application, it is crucial to ensure the strength of your relationship in order to prevent any potential losses. Netizen Two Hermits trust that this compilation of expenses has provided you with assistance in estimating the costs associated with applying for a BTO flat.

Since you’re here, why not read:

(Credits: Two Hermits)