People are investing in low-risk bonds in order to strengthen their portfolios in light of increased attention to personal assets. Discover Singapore Savings Bonds (SSB), a bond with a steady rise in interest rates and no capital loss!

What is SSB?

Singapore Savings Bonds (SSBs) are fully backed by the Singapore Government. You will not incur any capital losses and can always get your investment amounts back. SSBs offer step-up interest, so the longer one invests in them, the higher the interest income will be. One can also leave the SSB at any time without penalty since it is flexible.

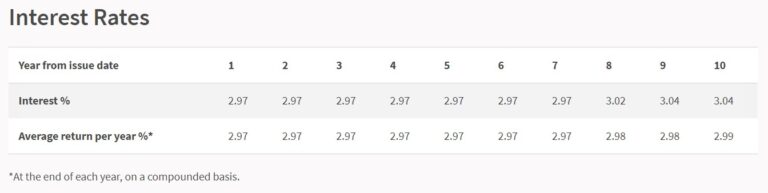

For each year that funds remain invested in the SSB, the interest rate increases progressively. You will benefit from higher interest rates and average annual returns the longer you remain invested in the SSB.

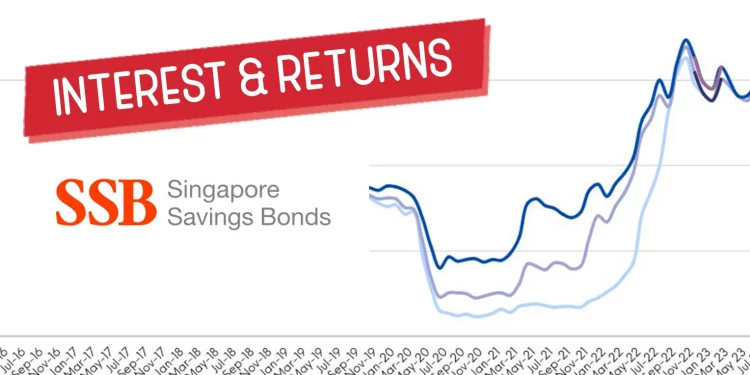

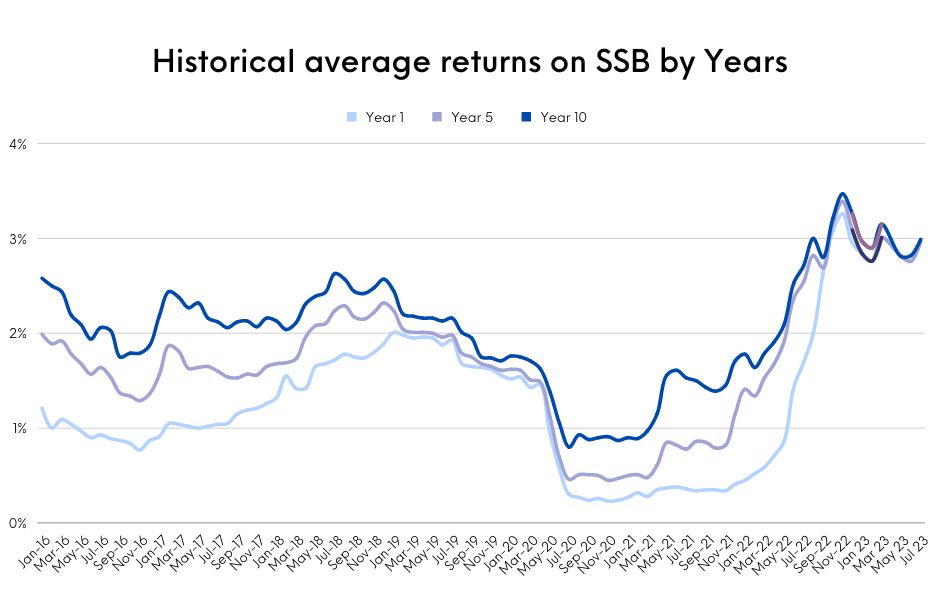

Singapore Savings Bonds were introduced in 2015. The interest rate was around 3-4% back then but dropped to below 1.5% in 2020. Today, interest rates are rising, and SSBs are gaining recognition.

The following are the interest rates for the upcoming tranche of August 2023:

Rates on SSBs just went back up! A 2.99% annual return is offered in the upcoming tranche.

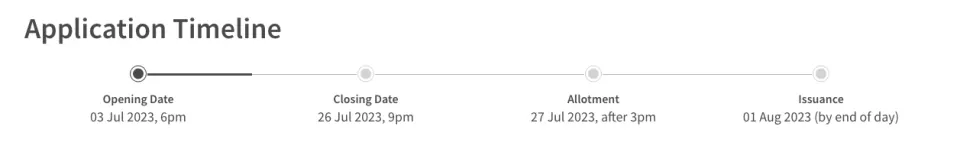

26 July 2023 is the deadline for applying for the Aug 2023 tranche.

What Are Singapore Savings Bonds?

This may sound complicated to some. So, what are they exactly?

By buying a bond, you are lending the government money every time the government issues one. The money you lend them is repaid with a small interest rate (more on this later).

Imagine the Singapore Government had its own bank. There’s only one ‘bank’ in this case, and that’s you. There is no limit to how much money people can contribute.

A new Singapore Savings Bond will be issued every month for at least the next five years after its launch by the Monetary Authority of Singapore (MAS). The MAS’ issuance calendar lists upcoming tranches.

Investors should be able to access long-term interest rate returns with maximum flexibility at no risk, according to the Government.

With SSB, your capital is always protected regardless of interest rate changes. Your $1000 investment will be returned to you at any time with interest. Interest rates do not pose any risks.

Three Quick-facts about SSB:

| No. | Description |

|---|---|

| #1 | Government bond tailored for long-term saving and investment purposes for Singaporean investors |

| #2 | Backed by the Singapore Government’s triple A credit rating, offering safe and principal-guaranteed investments with negligible risk, unless government bankruptcy occurs overnight |

| #3 | Key features of SSB: |

| – Flexibility to withdraw funds at any time without penalties | |

| – Opportunity to earn interest tied to long-term SGS rates |

Here’s a quick video summary of the key features of Singapore Savings Bonds:

Features of the SSB

1. Minimal risk

The Singapore Government’s credit rating by Moody’s, S&P, Fitch and R&I is Aaa, AAA, AAA, AAA and AAA respectively. As a result, Singapore Government investment offerings of SGS bonds, T-bills and Savings Bonds offer the lowest default risk and high creditworthiness, making them some of the safest investments to hold.

In addition to managing overall risk, the SSB can be a good way for Singaporean investors to diversify their investment portfolios. The investment also provides relatively good returns considering its low risk, making it a good investment for more conservative investors.

2. Flexibility and liquidity

Investors may wonder what the difference between SSB and fixed deposits is, since both are low in risk. Well, here is where the SSB shines – investors can exit the SSB without penalty for early redemption!

In contrast to fixed deposits, the SSB allows investors to withdraw their funds anytime, with a waiting period of one month. You do not need to decide during the initial stage of investing what period and duration you wish to invest for. SSB investments can be used as a sort of rainy-day fund, as they can always be withdrawn should unforeseen circumstances arise.

3. The ease of investing in SSBs

Additionally, SSBs are among the easiest and most accessible investment bonds. The application process for SSB is much easier than for other bonds or investment instruments that require signing up for an account on a specific trading platform.

The SSB is open to anyone over the age of 18. You only need a local bank account (DBS/POSB, OCBC, UOB) and a CDP (Central Depository) account linked to the local bank account. The SSB is also available as a cash investment or a SRS investment.

4. Minimum amount is low

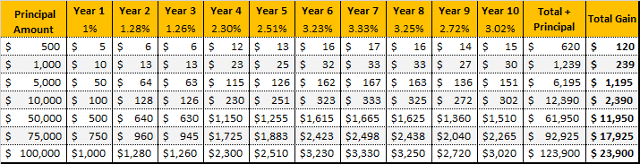

The minimum investment amount for SSB is S$500, and the investment sum should be multiples of S$500. For beginners and conservative investors alike, the S$500 entry point of the SSB makes it an easy investment opportunity.

5. Non-transferable

There is no transferability of SSB and it cannot be traded on the open market, traded on the Singapore Exchange or pledged as collateral.

The SSB can only be transferred to the rightful beneficiaries under the bondholder’s will or under the laws of intestacy in certain situations.

6. Interest rates are relatively high

A 10-year SSB may not offer the highest interest rates and returns for investors looking for high capital gains, with an average yearly return of 2.82%. In recent years, however, return rates have been steadily increasing as the economy has recovered. In 2018-2019, returns averaged 3.00%.

Furthermore, due to the SSB’s extremely low risk, its return rate could already be considered ideal.

Should You Invest in Singapore Savings Bonds?

When interest rates are high, SSBs are a great way to lock in long-term, guaranteed returns. The low-interest rates of 2020 to early 2022 might not be attractive to investors.

In recent months, rates have increased, so you may wonder if SSBs are worth investing in.

Flexibility is the SSB’s unique selling point. SSBs do not come with lock-in restrictions, which are common with conventional bonds.

SSBs have a maturity term of 10 years, but you can redeem them at any time before they mature. In addition, even if you redeem the bond early, the six-monthly interest will continue to be paid out to you. Tax-exempt returns are another advantage of investing in SSB.

How Long Should You Invest?

Ultimately, that’s up to you.

Due to the fact that you can withdraw your money without penalty at any time during the tenor of the bond, you do not have to decide how long you want to invest in advance.

You can expect a better return if you invest for a longer period of time. Is it worth your time to wait 10 years for your SSB?

SSB Interest Rate: How Much Can You Earn?

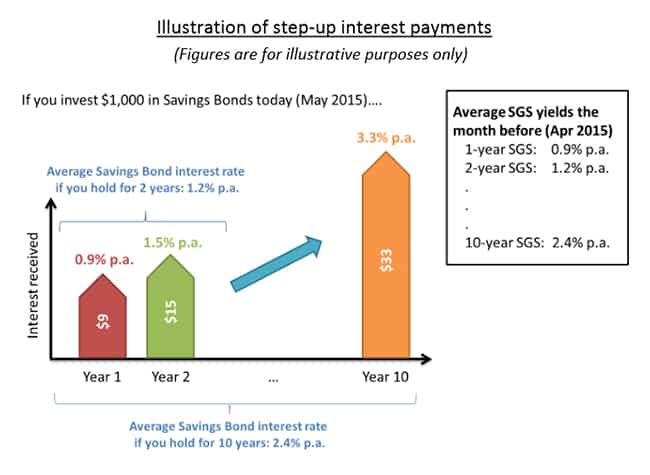

A link will be established between SSB interest rates and long-term SGS interest rates.

If you had purchased an SGS bond of equivalent tenor, you would have received the same average interest rate on the SSB.

SSB bonds offer “step-up” rates, which means that interest payments increase the longer you hold your bonds, unlike SGS bonds which pay the same interest every year.

To give you an idea of what to expect, the 10-year SGS has typically yielded between 2 and 3% in the past 10 years (before 2022), with the current yield at 3%.

Over a period of 10 years, an investment of S$10,000 will yield an average interest rate of $300 a year or $30 a month.

For conservative investors, the SSB’s interest rates aren’t bad.

While they weren’t as high as long-term CPF funds, they were at least higher than short-term fixed deposits and savings accounts.

Go for the SSB instead of the banks if you’re looking to park your savings (under $100,000).

How to find the latest SSB rates?

Go to MAS’s website for the latest information.

How To Buy & Invest In SSB?

Before you apply

To apply for Singapore Savings Bonds, you will need the following information:

A bank account (or online banking) with one of the participating banks – currently DBS/POSB, OCBC, or UOB. It is possible that more banks will be included in the future.

It is an individual CDP Securities account (not joint) with Direct Crediting Service activated. To open an individual CDP Securities account, you must be at least 18 years old.

For the next five years, a new SSB will be issued every month. Every SSB issue will have an application window that opens on the first business day of the month and closes four business days before the end of the month.

You can apply through any participating bank’s ATM or online banking platform. Requests must be made in multiples of $500. Each application is subject to a $2 transaction fee (non-refundable).

SSB can currently be purchased with cash or Supplementary Retirement Scheme (SRS) funds. People may be able to buy SSB using their CPF savings in the future.

Step-By-Step Guide on Investing in SSB

How Will I Know If My Application Is Successful?

Your application’s success depends on the demand for the SSB in that tranche.

Before the application opens, the issuance size for each SSB tranche will be announced. A monthly allocation of bonds will be made by MAS if the demand for bonds exceeds the amount of bonds available.

Are you considering investing in the SSB, but aren’t sure how to do so? Here are all the steps you need to invest in SSB easily and quickly:

Anyone can apply for the SSB. For the application to be submitted, you must be 18 years old or older to have a Central Depository (CDP) account.

SSBs are issued on the first business day of every month. You can invest as little as $500 and as much as $200,000.

To apply, you can either use cash (DBS/POSB, OCBC, UOB ATMs, Internet Banking, and OCBC’s mobile banking application) or Supplementary Retirement Scheme (SRS) through your SRS operator’s Internet banking portal.

By Cash

1. You Will Need:

a) A bank account with DBS/POSB, UOB or OCBC.

b) An individual CDP Securities account with Direct Crediting Service (DCS) activated.

2. Apply either via ATMs or Internet Banking Portals.

a) Log in to your bank’s internet banking, ATM, or OCBC’s mobile banking app. Be sure to have your CDP account number with you.

b) Upon application, the amount invested will be deducted from the bank account tied to your ATM card or Internet banking account.

c) A S$2 transaction fee applies for each SSB application request.

Note: Requesting an SSB application does not guarantee an allotment of the SSB.

3. SSB Allotment Results

a) MAS will allot the latest SSB to the applicants on the third last business day of each month (known as Allotment Day). You may check the application results on MAS’s website at 3pm on Allotment Day.

b) The SSB will then be issued on the first business day of the following month.

c) CDP will notify you (by mail) of the amount of SSB that has been allotted to you. You can also check your allotment and holdings through the CDP Internet service or by calling (65) 6535-7511.

d) You can manage all your SSB holdings on the My Savings Bonds portal.

4. Refunds for Partially or Non-Filled Applications

a) You may not be allotted the full amount you applied for, since there is a possibility that the total SSB application amount exceeds the total SSB amount on offer in a particular month.

b) The excess cash will be refunded by the end of the second last business day of the month.

c) The bank’s S$2 transaction fee is non-refundable.

5. Interest payments

a) Interest will be paid to the bank account linked to your CDP account.

b) Interest is paid out every six months, on the first business day of each month.

c) The cash payments will be reflected on your CDP statement.

By SRS

1. You will need

a) An SRS account (you can open an SRS account by visiting one of the three SRS operators (DBS/POSB, OCBC, UOB).

2. Apply via the Internet Banking Portal

a) Apply for SSB via your SRS operator’s Internet banking portal.

b) The SRS funds will be locked or earmarked when you apply.

c) There will be a $2 transaction fee charged for each application request.

Take note that application requests cannot be amended or canceled. The SSB cannot also be applied for at bank counters.

3. SSB Allotment Results

a) MAS will allot the latest SSB to the applicants on the 3rd last business day of each month (Allotment Day). You may check the application results on MAS website at 3pm on Allotment Day.

b) The SSB will then be issued on the 1st business day of the following month.

c) Your SRS operator will notify you by mail, of the amount of SSB that has been allotted to you. You may also check your allotment and holdings with your SRS operator.

d) You can also manage all your SSB holdings on the My Savings Bonds portal.

4. Interest payments

a) Interest will be paid into your SRS account.

b) It will be paid out every 6 months, on the 1st business day of each month.

c) The cash payments will be reflected in your SRS statements.

If you are planning to buy in the SSB this month, please take note of the below application and redemption timelines The closing date for the July 2023 round of SSB applications will be 9pm on 26 July 2023.

How To Redeem?

Redemption is similar to application – submit your request at any participating bank’s ATM, or via DBS/POSB’s internet banking. Your cash (along with any interest accrued) will be deposited back into the bank account linked to your CDP Securities account.

Please note, however, that redemption proceeds will only be processed by the second business day of the following month.

Don’t invest all of your nest egg in the SSB; keep an emergency fund separate in case you need it quickly.

Kick-Start Your Investment Journey

After learning more about SSB, you might want to continue searching for more investments and alternatives! To kick-start your investment journey, visit our investments page for tips and beginner-friendly guides!

Since you’re here, why not read:

https://lobangsiah.sg/different-goverment-bond-option-singapore-government-securities-bond-singapore-saving-bonds-and-t-bills/

(Credits: Drwealth, MAS)