This ultimate guide is for those who are applying for their first credit card in Singapore since there are a number of credit card options available in the market.

For your convenience, we have provided you with a guide on how to apply for credit cards in Singapore. Learn more about the different types of credit cards available, credit card terms, and how to use our credit card comparison in Singapore to find the right card for you.

What are the benefits of applying for a credit card? It is certainly true that having a credit card for your expenses will provide you with a wide range of benefits, giving you the flexibility to make purchases now and pay for them later.

Earn rewards while spending Everyone enjoys earning rewards when they make purchases. The rewards you may receive will vary depending on the type of credit card you apply for. Most credit card companies offer the following rewards:

If you accumulate cashback or rebates on your credit card, you may be able to use them to offset your next bill, saving you money. For every Singapore Dollar you spend, you can earn air miles, which can be redeemed for flights and upgraded on your next trip.

If your card allows you to collect reward points, you may redeem these points for vouchers or products from participating merchants. Whether it’s dining or petrol rewards, you’re sure to find something that appeals to you!

Unlike debit cards, credit cards provide you with a higher spending limit. As opposed to withdrawing funds from your bank account, you will have a credit limit, which essentially serves as a restriction on your spending. You can therefore purchase anything within your credit limit with just a tap of your credit card.

Despite the fact that this may sound exciting, you must spend your money responsibly. Once you have built your own credit score, you will ultimately be able to obtain loans and apply for more credit cards in the future.

In Singapore, the minimum age requirement for obtaining a credit card as the primary cardholder is 21 years of age for most banks. It is also possible to obtain a credit card designed specifically for students, with an age requirement of usually 18 years or older.

Before applying for a credit card, it is important to review the terms and conditions.

Singapore only allows credit card companies to issue credit cards to individuals if they meet certain requirements established by the Monetary Authority of Singapore (MAS):

- Annual income of at least SGD 30,000, including non-employment income

- Personal net asset value of at least SGD 1.5 million

- Total net financial assets of at least SGD 750,000

- Total net assets of at least SGD 2 million

Singapore credit card companies typically require foreigners to earn a minimum salary of SGD 40,000 in order to qualify for a credit card.

MAS has also established credit limits in addition to the above minimum requirements. Based on individual net assets and total net financial assets, the credit limit varies from at least SGD 30,000 to up to four months’ income.

Now, let’s explain some credit card terms for those who are unfamiliar with them. Below is a table summarizing the definitions of commonly used terms:

| Term | Definition |

|---|---|

| Annual fee | Yearly membership fee for the credit card |

| Annual percentage rate | The annual interest rate charged if you carry a balance on your credit card |

| Base cardholder | The primary individual who owns the credit card |

| Supplementary cardholder | Additional individuals issued supplementary cards by the base cardholder |

| Cash advance | Short-term loan provided by your credit card |

| Issuing institution | The organization that provides your credit card |

| Credit limit | The maximum amount you can charge on the credit card |

| Credit score | A numerical reflection of your creditworthiness, based on your credit history |

| Finance charge | The fees, interest, and charges incurred if you don’t fully repay within the grace period |

Would you like to know which credit card is most suitable for you?

The benefits of different credit cards will vary depending on your lifestyle and spending habits. To maximize your savings and rewards, it is necessary to analyze your spending habits and lifestyle before using a credit card.

Credit cards offering cash back Essentially, cashback credit cards offer rebates on purchases. There are some credit cards that offer a consistent cashback rate for all purchases, such as the American Express True Cashback Card.

Alternatively, some cards offer higher cashback rates based on your spending, such as Citibank’s cashback cards. You will receive these rebates or cashback on your bill. These rebates or cashback can be redeemed at participating merchants to offset the cost of your next purchase.

You will benefit from air miles and credit cards if you are an avid traveler. Since countries have already reopened their borders, travel is expected to grow, although it may not reach the levels experienced prior to COVID-19. You can earn miles for every Singapore Dollar spent by using an air miles credit card.

1) American Express Singapore Airlines KrisFlyer Card

| Credit Card | Conversion Rate |

|---|---|

| American Express Singapore Airlines KrisFlyer Card | – 2 miles for every SGD 1 spent on Singapore Airlines’ online platforms (SingaporeAir website and app, SilkAir, KrisShop in-flight, and online) – 2 miles for every SGD 1 spent on overseas foreign currency – 3.1 miles for every SGD 1 spent on Grab transactions in December |

As a loyalty perk, it rewards customers who spend more on the credit card, since the more you spend, the more miles you earn. Miles can be redeemed for products, flights, and flight upgrades.

Cards designed specifically for younger consumers with lower budgets typically have lower fixed fees and credit limits and do not require a minimum income.

2) Citibank Clear Card

| Criteria | Details |

|---|---|

| Annual Fee | SGD 29.96 (waived for the first year) |

| Eligibility | Students over the age of 18 |

| Credit Limit | SGD 500 |

| Minimum Income Requirement | No minimum income requirement |

| Financial Capacity | Prevents users from exceeding their financial capacity |

There are several student-friendly options available. It is important to note that there are also alternative options, such as debit cards linked to your checking account. In order to make an informed decision, it is important to explore your options.

The majority of electronic payments in Singapore are processed by Visa, Mastercard, and American Express. However, American Express is the only company that issues debit and credit cards.

There are no significant differences between Visa and Mastercard. There is a similar acceptance rate for both methods in Singapore and abroad, as most merchants, both offline and online, accept both.

In spite of this, their loyalty programs differ significantly. The Mastercard payment network offers more promotions than other networks, and higher-tier cards often provide better benefits.

One of American Express’s key distinguishing features is its perks. Having the ability to partner with merchants allows them to offer better deals, particularly in the dining and travel sectors. There are, however, certain conditions that must be met in order to become a member of their program.

Since you’re here, why not read:

Comparing credit cards across various categories in Singapore – Find the best credit card for you We have listed our preferred credit cards in the following categories to assist you in selecting the right card for your lifestyle and needs.

3) UOB One Card

Best Ultimate Cashback Credit Cards in Singapore: Annual fee: SGD 192.60 (waived for the first year)

| Categories | Cashback | Cap per Quarter |

|---|---|---|

| General Spending | 5% | Up to SGD 300 |

| Grab, Shopee, Dairy Farm SG | 10% | Up to SGD 100 |

| Utility Bills | 6% | Up to SGD 100 |

|---|---|---|

| Minimum Transactions/Month | 5 | |

| Minimum Minutes Spending | 1,000 (6% cashback) | 500 (3.33% cashback) |

| Cashback if No Earnings | 0.03% |

| in Calendar Year | ||

|---|---|---|

| Additional Savings: | ||

| Shell | Up to 21.15% savings | |

| SPC | Up to 24% savings |

| Minimum Spend | SGD 500 | |

|---|---|---|

| Cashback if No Earnings | 0.03% |

With the UOB One Card, cardholders can earn up to 5% cash back on all purchases. This is if they spend at least SGD 2,000 per month for three consecutive months. Grab transactions will earn a 10% cashback rate while recurring bills will receive a 6% cashback rate.

In this quarterly system, the income is likely to be higher for those with stable expenses, but it may be lower for those with fluctuating incomes or lower spending.

Cardholders who spend SGD 1,000 or SGD 500,000 per month can earn 3.33% cashback, up to a maximum of SGD 100 or SGD 50 per quarter, respectively. The UOB Smart$ Cashback Program, which complements cashback with additional savings and discounts, is available to all cardholders.

Keeping a consistent budget may allow you to maximize your cashback. The UOB One Card offers 5% cashback on all purchases if you spend a minimum of SGD 2,000 per month for three consecutive months. There has been an increase in the cashback rate for Grab transactions to 10%, while the cashback rate for recurring bills has increased to 6%.

Individuals with stable expenses may benefit from this quarterly system, but those with lower expenses or fluctuating income may experience a lower income. A cardholder who spends SGD 1,000 or SGD 500,000 per month in this quarter can earn 3.33% cashback, up to SGD 100 or SGD 50 per quarter, respectively. Nonetheless, all cardholders can benefit from the UOB Smart$ Cashback Program, which offers additional savings and discounts in addition to cashback.

Take advantage of discounts of up to 10% on all expenses, as well as quarterly promotions of up to SGD 300. You can read our complete review here. A fee of SGD 192.60 is charged annually (waived for the first year). You can earn 5% cash back on general expenses, up to SGD 300 per quarter (with a minimum of five transactions per month). Grab, Shopee, Dairy Farm Singapore, and select UOB travel services are eligible for 10% cashback. You can earn 6% cashback on utility bills, up to SGD 100 per quarter (for a minimum purchase of SGD 1,000). Spend a minimum of SGD 500 to receive 3.33% cashback. The cashback rate will be 0.03% if there is no cashback earned in a calendar year. Shell offers savings of up to 21.15 percent and SPC offers savings of up to 24 percent.

A UOB Bank credit cardholder can receive 5% cash back on all purchases if they spend SGD 2,000 per month (approximately CNY 15,000) consecutively for three months, 10% cashback on Grab transactions, and 6% cashback on recurring bills with a card. In this quarterly system, those with stable spending benefits, but those with lower spending or inconsistent income may experience a decrease in earnings.

During this quarter, you can earn 3.33% cash back on SGD 1,000 or SGD 500,000 in monthly spending. This is up to SGD 100 or SGD 50 per quarter, respectively. However, all cardholders are eligible for UOB Bank’s Smart$ cashback program, which offers additional discounts and savings in addition to the cashback.

With a stable budget, you may be able to maximize your earnings on all expenses. A cardholder who spends SGD 2,000 per month (approximately CNY 15,000) for three consecutive months can receive 5% cashback on all purchases, 10% cashback on Grab transactions, and 6% cashback on recurring bills. As a result of this quarterly system, those whose expenditures are stable will be able to earn more, while those with lower expenditures or inconsistent earnings may be unable to earn as much.

During this quarter, you can earn 3.33% cash back on SGD 1,000 or SGD 500,000 in monthly spending, up to SGD 100 or SGD 50 per quarter, respectively. However, all cardholders are eligible for UOB Bank’s Smart$ cashback program, which offers additional discounts and savings in addition to the cashback.

4) DBS Altitude Visa Card

Affordable extra perks and fee waivers Earn 5 miles for every SGD 1 spent on online flight and hotel transactions and overseas purchases. Using this card will allow you to earn miles that will never expire. This promotion is only applicable to new DBS/POSB credit card members.

You can read our full review here. For the first year, there is a waiver of the annual fee of SGD 192.60.

| – Minimum annual expenditure of SGD 25,000 for fee waiver and 10,000 miles |

|---|

| Earned Miles: |

| – 2 miles for every SGD 1 spent locally |

| – 2 miles for every SGD 1 spent in foreign currency |

| – 3 miles for every SGD 1 spent on: |

| – Online shopping |

| – Online flight bookings |

| – Hotel bookings |

| – Miles earned do not expire |

|---|

| Additional Benefits: |

| – Complimentary travel insurance |

| – Two lounge visits |

| – Golf privileges |

Earn 2 miles for every SGD 1 spent locally, 2 miles for every SGD 1 spent in foreign currency, and 3 miles for every SGD 1 spent on online shopping, online flight bookings, and hotel bookings. A 0% interest installment payment plan is available from DBS My Preferred Payment Plan.

With the DBS Altitude Visa Card, you can enjoy high mileage rates as well as a variety of luxurious benefits at an affordable price. Upon spending SGD 1 on local expenses, cardholders will earn 1.2 miles, 2 miles for spending SGD 1 abroad, and 3 miles for booking online travel. Earned miles do not expire. Additionally, consumers will receive two complimentary lounge visits per year, along with dining and golf privileges. There is even free travel insurance available to cardholders.

The already affordable SGD 192.6 fee has been waived, and with a minimum annual spend of SGD 25,000, the DBS Altitude Visa Card becomes an excellent choice for budget-conscious travelers. In addition to offering high mileage rates and luxury benefits, this card is among the most affordable travel cards available.

For every SGD 1 spent on local expenses, cardholders earn 1.2 miles, for every SGD 1 spent overseas, and for every SGD 1 spent on online travel bookings. Miles earned never expire. Additionally, consumers are entitled to two complimentary lounge visits per year, along with dining and golf privileges.

Additionally, cardholders are entitled to free comprehensive travel insurance. As the SGD 192.6 fee and the minimum annual spend of SGD 25,000 are waived, the DBS Altitude Visa Card is an excellent option for budget-conscious travelers.

You will receive 5 miles for every SGD 1 spent on online flight and hotel transactions and overseas purchases, and your miles will never expire. This promotion is only available to new members of DBS/POSB credit cards. You can read our full review here. The annual fee is SGD 192.60 (waived in the first year). There are two alternative options: Pay the annual fee and receive 10,000 bonus miles or incur a minimum annual expenditure of SGD 25,000 and receive a fee waiver and 10,000 bonus miles. Earn 2 miles for every SGD 1 spent locally, 2 miles for every SGD 1 spent in the east, and 3 miles for every SGD 1 spent on online shopping, online flight bookings, and hotel reservations. Miles earned never expire. A complimentary travel insurance policy is included, as well as two lounge visits, golf, and dining privileges. 0% interest installment payment plan offered by DBS.

The DBS Altitude Visa Card is one of the most affordable travel cards on the market, offering high mileage rates and luxurious benefits. The cardholder earns 1.2 miles for every SGD 1 spent locally, 2 miles for every SGD 1 spent abroad, and 3 miles for every SGD 1 spent on online travel reservations, and the miles do not expire.

Even better, consumers will be able to enjoy two complimentary lounge visits per year, as well as dining and golf privileges. Travel insurance is also provided free of charge to cardholders. The already reasonable fee of SGD 192.6 has been waived, and with an annual spend of SGD 25,000, the DBS Altitude Visa Card becomes an excellent choice for budget-conscious travelers. This makes it one of the most affordable travel cards that provide both high mileage rates and luxurious amenities.

Airline / Hotel Transfer Partners

| Airline / Hotel | Frequent Flyer Program | Conversion Rate |

|---|---|---|

| AirAsia | Big Loyalty | 5,000 : 10,000 |

| Cathay Airways | Asia Miles | 5,000 : 10,000 |

| Singapore Airlines | Krisflyer Miles | 5,000 : 10,000 |

| Qantas Airways | Qantas Frequent Flyer | 5,000 : 10,000 |

DBS has the standard Singapore Krisflyer and Cathay Airways Asia Miles program that almost every other bank provides. In addition, it also has Qantas and AirAsia (probably shouldn’t bother) as its transfer partners.

Transfer of points costs S$27.00 (w/ 8% GST) each time.

Luckily for people with multiple DBS Credit Cards, DBS Points are pooled together. This means that if you own both a DBS Altitude card and a DBS Woman’s World Mastercard, you can redeem points earned from both cards with a single transaction, saving you some money.

With this card, cardholders earn 1.2 miles for every SGD 1 spent on local expenses, 2 miles for every SGD 1 spent overseas, and 3 miles for every SGD 1 spent on online travel bookings. Miles earned never expire. Additionally, consumers can enjoy two complimentary lounge visits per year, as well as dining and golf privileges.

Since you’re here, why not read:

Travel insurance is even provided free of charge to cardholders. The already reasonable annual fee of SGD 192.6 has been waived, making the DBS Altitude Visa Card an excellent choice for budget-conscious travelers.

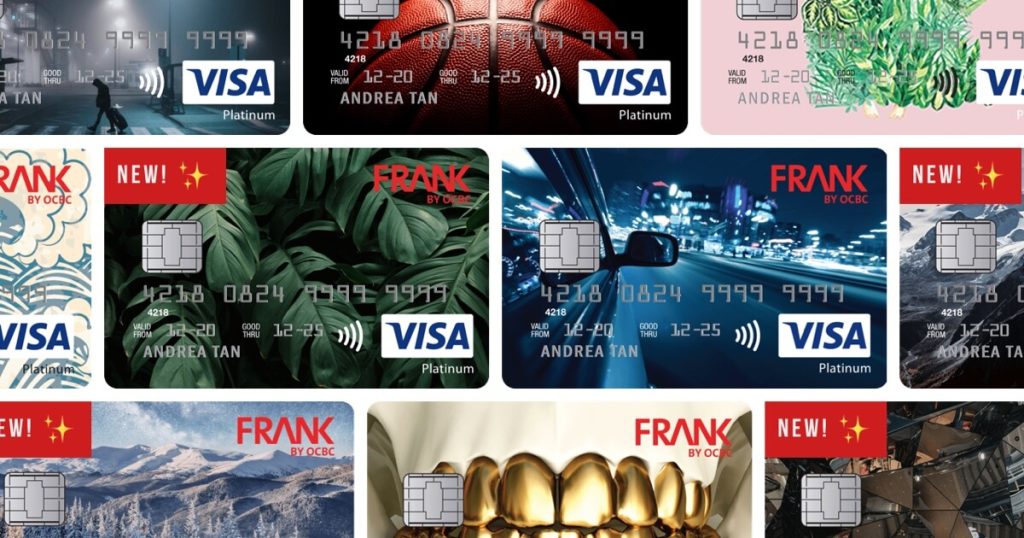

5) OCBC Frank Card

Best Student-Friendly Credit Card in Singapore: No-Fee Rebates on Online Spending With a promotional campaign of only SGD 600 per month, you will receive a 6% discount on FX, online, and mobile shopping. You can read our full review here. An annual fee of SGD 80 is charged (waived for the first two years). Spending online and through apps is automatically exempt from fees. For mobile contactless payments (Apple Pay, Samsung Pay, Google Pay, Garmin Pay, and Fitbit Pay), a minimum annual spend of SGD 10,000 is required. There is a 6% discount on foreign currency purchases. All other expenses will be subject to a 3% cashback rate with a maximum monthly cashback cap of SGD 75.

A 6% discount is offered on foreign currency, online purchases, and mobile contactless payments with the OCBC Frank Card. There is no minimum spending requirement for cardholders to earn a 0.3% rebate on all other purchases. It covers a wide range of eligible online expenditures, including retail purchases as well as travel bookings.

With a minimum spending requirement of only SGD 600, it is among the lowest in the market, and consumers who spend SGD 10,000 annually are also exempt from paying an annual fee. Its user-friendly features make the OCBC Frank Card an ideal choice for young individuals with limited budgets who wish to earn high rewards at the same time.

With just a spending of SGD 600, young individuals can earn substantial rebates with OCBC Frank Card, which offers 6% rebates on FX, online, and mobile contactless transactions. Additionally, cardholders may earn a 0.3% rebate on all other purchases without a minimum spending requirement. Various online purchases are eligible for coverage, from retail purchases to travel reservations.

A minimum spending requirement of only SGD 600 makes it one of the lowest on the market, and consumers who spend at least SGD 10,000 annually are exempt from the annual fee. With these features, the OCBC Frank Card is particularly user-friendly, making it a good choice for individuals with a limited budget who are seeking high rewards while maintaining a limited budget.

Take advantage of a 6% discount on foreign currency, online, and mobile shopping with monthly spending of just SGD 600. Take a look at our full review. Fee: SGD 80 per year (waived for the first two years). Fee waiver for online and app purchases. The minimum annual spend for a 6% discount on mobile contactless payments (Apple Pay, Samsung Pay, Google Pay, Garmin Pay, and Fitbit Pay) is SGD 10,000. Foreign currency purchases are eligible for a 6% discount. 3% cash back on all other expenses, with a maximum of SGD 75 per month.

A 6% discount is offered on foreign currency, online purchases, and mobile contactless payments with the OCBC Frank Card. There is no minimum spending requirement for cardholders to earn a 0.3% rebate on all other purchases. It covers a wide range of eligible online expenditures, including retail purchases as well as travel bookings.

With a minimum spending requirement of only SGD 600, it is among the lowest in the market, and consumers who spend SGD 10,000 annually are also exempt from paying an annual fee. Its user-friendly features make the OCBC Frank Card an ideal choice for young individuals with limited budgets who wish to earn high rewards at the same time.

Those looking to earn substantial rebates with as little as SGD 600 of spending may want to consider the OCBC Frank Card, which offers a 6% rebate on FX transactions, online purchases, and mobile contactless transactions. On all other purchases, cardholders can earn an additional 0.3% rebate without a minimum spending requirement. Online shopping, travel bookings, and other eligible spending are all covered by the program.

SGD 600 is one of the lowest minimum spending requirements in the market, and consumers who spend SGD 10,000 annually are also eligible for an annual fee waiver. With these features, the OCBC Frank Card is particularly user-friendly and a good choice for young individuals on a tight budget but who wish to earn attractive rewards at the same time.

How to Apply for a Credit Card in Singapore

- Credit Card Application: By clicking on our links above, you will be able to apply for a credit card. Alternatively, you may contact the nearest branch of the bank of your choice or apply online.

Make sure to read the terms and conditions before registering.

- Check Your Eligibility Fill out the application form to assist the bank in evaluating your credit rating and eligibility.

- Submit Documents The required documents may vary depending on the bank you are applying to. Generally, banks will ask for copies of the following documents:

For Singaporeans:

- NRIC (front and back)

- Latest 12 months’ CPF statements

- Latest income tax notice of assessment

- Latest computerized payslips

For Salaried Employees:

- Latest 12 months’ CPF statements

- Latest income tax notice of assessment

- Latest computerized payslips

For Self-Employed Individuals:

- Latest income tax notice of assessment

- Latest bank statements

For Foreigners:

- Valid passport

- Employment pass (front and back)

- Proof of residence (utility bills, phone bills)

- Latest income tax notice of assessment

- Latest computerized payslips

- Sit back and wait for your credit card application to be approved. The process typically takes 10 to 14 business days. A credit card letter will be sent to you once you have been approved.

- Activate Your Card Inside the new credit card that comes with the letter, there should be a guide to help you activate the credit card through a phone call or verification SMS. Alternatively, you can use the bank’s website or mobile application to do this.

Looking for a credit card that fits your lifestyle, but you are tired of browsing through the websites of various banks? Providing you with convenience, we have compiled the best cards for each category in this article. We hope it helps!

Since you’re here, why not read:

(Credits: shrugmyshoulder, fifth storey)